I still remember the frustration of watching my trades suffer due to brokers altering spreads. Every second counted, but the sudden widening of spreads caused unexpected losses and missed opportunities. That’s when I realized the importance of understanding how brokers manipulate spreads and how to counteract their impact. Switching to a transparent broker and closely monitoring spread fluctuations made a huge difference. My trades became more predictable, reducing unnecessary costs and improving profitability. If you’re struggling with inconsistent spreads, don’t ignore the issue—spread manipulation can significantly impact your trading success!

How Brokers Altering Spreads Affected My Trading

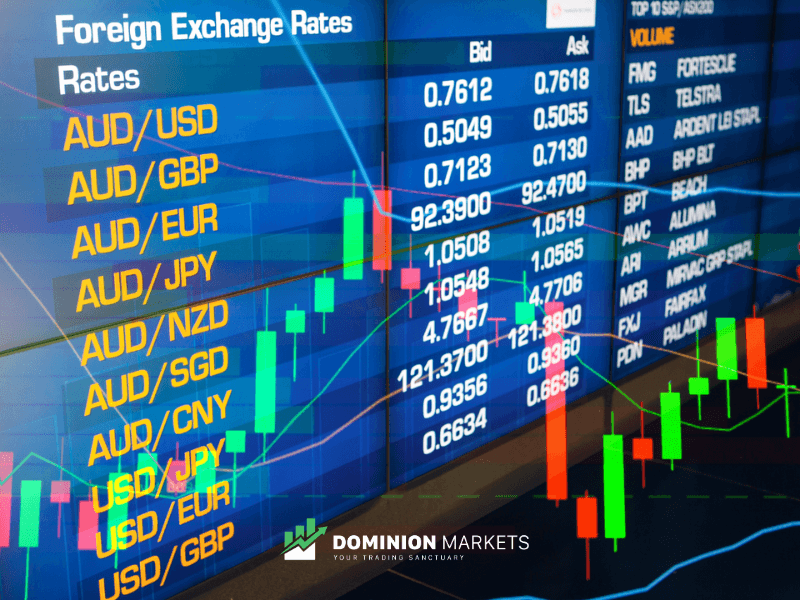

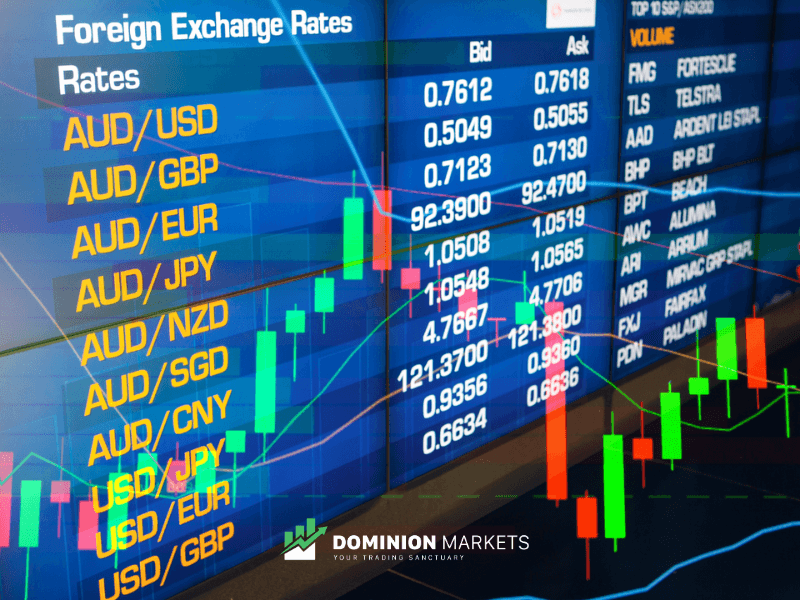

Forex trading is an exciting but challenging journey. Imagine this: You enter a trade with a reasonable spread, expecting a smooth entry. Suddenly, the spread widens dramatically, and your position is executed at an unfavorable price. You watch in disbelief as your stop-loss triggers prematurely or your profits shrink.

This is a common issue where brokers alter spreads, impacting traders worldwide. Many beginners believe it’s just market volatility, while others think brokers intentionally adjust spreads to their disadvantage. But is it manipulation or just market dynamics? Understanding why spreads widen and how to counteract these fluctuations can help you manage your trades better and maximize profits.

Reads more : Execution Speeds

Understanding the Problem

Brokers alter spreads by widening the difference between the bid and ask price, often during volatile market conditions or specific trading hours. This can lead to increased trading costs, slippage, and unexpected losses. Several factors influence spread widening, including liquidity, broker policies, and market volatility.

One primary reason for spread manipulation is high market volatility. The forex market rushes, and during significant news events, spreads can widen significantly. Some brokers, especially market makers, may intentionally alter spreads to maximize profits. Also, low-liquidity conditions can cause natural spread fluctuations, making entering or exiting trades at optimal prices difficult.

Solutions to Avoid Issues with Brokers Altering Spreads

If you’ve ever faced sudden spread widening that negatively affected your trades, it’s crucial to implement strategies to mitigate its impact. Below are practical steps to ensure you trade in a more stable and predictable environment.

Choose a Transparent Broker

Not all brokers engage in unfair spread alterations. Choosing a well-regulated broker with a strong reputation for transparency can help reduce the risk of manipulation. ECN (Electronic Communication Network) brokers typically offer raw spreads without hidden markups, ensuring fairer pricing.

Select the Right Trading Account Type

Different brokers offer various account types, some of which have fixed spreads while others have variable spreads. Fixed-spread accounts can protect you from unexpected spread widening, although they may have slightly higher costs. If you prefer variable spreads, ensure your broker has a fair pricing policy.

Monitor Spread Fluctuations

Keeping an eye on spread behavior can help you identify patterns of manipulation. Use trading platforms that display real-time spread charts, allowing you to track changes and avoid placing trades during suspicious fluctuations. Comparing spreads across multiple brokers can also reveal inconsistencies.

Trade During Stable Market Conditions

Spreads tend to widen during major economic announcements, low-liquidity periods, and market openings/closings. Trading during stable periods, such as the overlap of the London and New York sessions, can help avoid excessive spread fluctuations.

Use Limit Orders Instead of Market Orders

Market orders are executed at the best price, which can significantly impact widened spreads. Using limit orders ensures that trades are executed only at a specified price, preventing unexpected spread-related losses.

Avoid Trading Before Major News Events

Brokers often widen spreads during high-impact economic announcements, such as interest rate decisions, employment reports, and GDP releases. If you must trade during these times, be prepared for increased costs or wait until the market stabilizes.

Reads more : Execution Speeds

Pro Tips for Advanced Traders

- Use a Virtual Private Server (VPS): A VPS allows traders to maintain a stable connection to the trading server, reducing delays that could expose them to sudden spread widening. This is particularly useful for algorithmic traders who rely on precise order execution.

- Monitor Broker Behavior: Some brokers consistently alter spreads during peak trading hours. Regularly reviewing execution reports and comparing brokers can help you identify and switch to a more reliable provider.

- Optimize Risk Management Strategies: A well-placed stop loss and adjusting your trade size based on average spread fluctuations can minimize unexpected losses caused by spread manipulation.

By implementing these strategies, traders can reduce the risks associated with brokers altering spreads and improve overall trade efficiency. Minimizing spread-related costs ensures better trade execution, enhanced profitability, and long-term success.

Frequently Asked Questions About Brokers Altering Spreads

Many traders struggle with spread manipulation and its impact on their profits. Below are common questions traders ask and practical answers to help them refine their strategies.

Why do spreads widen unexpectedly?

Several factors cause spreads to widen, including market volatility, low liquidity, and broker policies.

Solution:

- Trade with a transparent ECN broker that offers raw spreads.

- Avoid trading during news events and illiquid market hours.

- Monitor real-time spreads to identify manipulation patterns.

Can brokers manipulate spreads unfairly?

Yes, some market maker brokers alter spreads to maximize profits at the trader’s expense. However, well-regulated brokers adhere to strict policies to ensure fair pricing.

Solution:

- Trade with a well-regulated broker that offers competitive and transparent spreads.

- Compare multiple brokers to find the most reliable option.

- Check historical spread data to identify suspicious fluctuations.

What tools can help track spread fluctuations?

Several tools allow traders to monitor spreads and avoid unfavorable trading conditions.

Useful tools:

- Spread Monitoring Software – Tracks spread changes in real time.

- Broker Comparison Websites – Helps find brokers with the most stable spreads.

- Trading Journals – Allows traders to log spread fluctuations and adjust strategies accordingly.

Example:

If you notice that a broker consistently widens spreads during peak hours, switching to an ECN broker with raw spreads can improve execution conditions.

How can I protect my trades from sudden spread widening?

Unforeseen spread manipulation can negatively impact your trades, but you can minimize risks.

Solution:

- Use limit orders instead of market orders.

- Trade during stable market conditions.

- Keep an eye on broker performance and switch if necessary.

Conclusion

Brokers altering spreads can significantly impact forex trading success. Sudden spread widening can increase trading costs, slippage, and missed opportunities. To protect yourself, choose a transparent broker, monitor spreads regularly, use limit orders, and avoid high-volatility periods. Understanding market conditions, selecting the correct account type, and optimizing risk management strategies can help you trade more effectively. Reducing spread manipulation risks ensures better trade execution and long-term profitability in forex trading.

“Have you ever experienced unfair spread widening? Share your experience in the comments below. Let’s learn from each other and refine our trading strategies!”

Recommended Next Steps

- Learn how to monitor spread fluctuations and identify manipulation patterns.

- Compare brokers to find the one with the most stable spreads.

- Test different account types on a demo account before committing to a live account.

- Keep track of spread data to improve risk management strategies.

Expand Your Knowledge

📌 Forex Trading Learning Road Map

📌 Forex Trading Course with no Fees

📌 Forex Trading Issues, Problems, and Solutions

📌 Forex Daily Forecast & Live Updates